ohio unemployment income tax refund

Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. To check on your refund pay your taxes or file online visit.

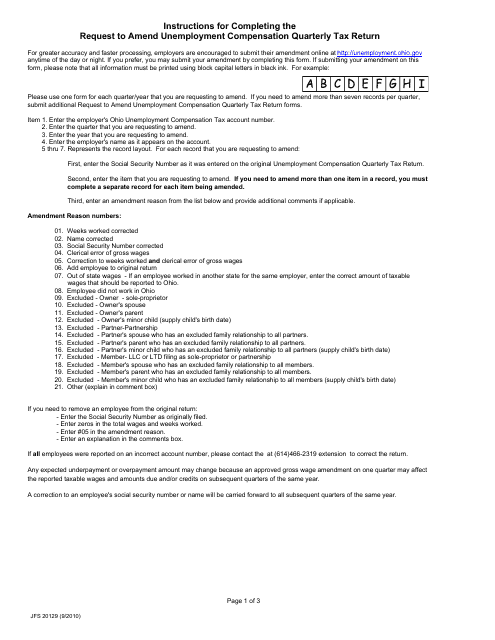

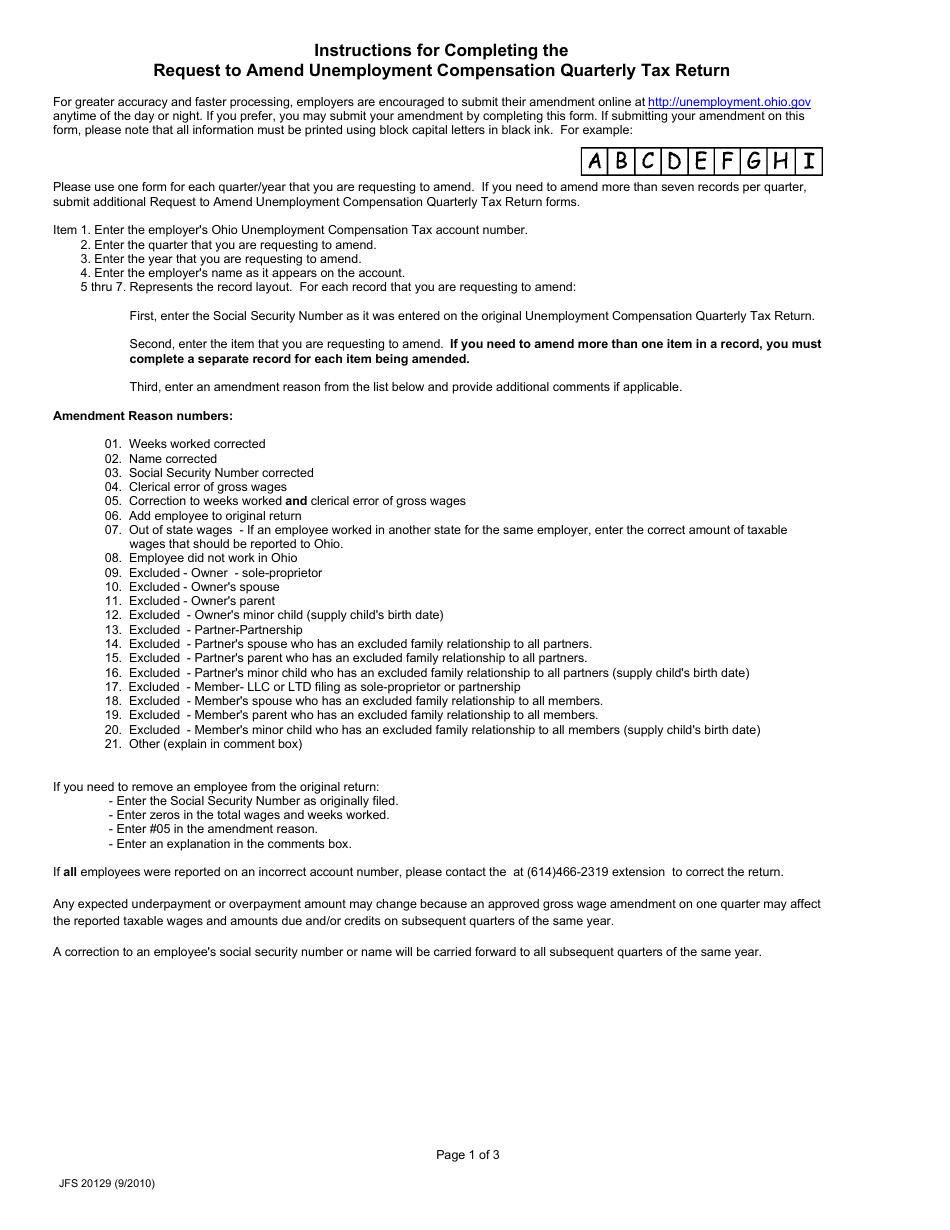

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return.

. Please do not submit an Ohio ID theft affidavit IT TA with ODT for this reason unless a fraudulent income tax return Ohio IT 1040 was filed with Ohio using your social security number. The exclusion is 10200 per person so spouses filing a joint return can avoid paying taxes on up to. Certain married taxpayers who both received unemployment benefits can each.

File an amended Ohio IT 1040 and an amended SD 100 for those who reside in a traditional tax base school district to report your new federal adjusted gross. Mike DeWine Wednesday. I filed my taxes in March before the 10200 tax break with turbo tax.

Check the status of your refund. Due to the Federal American Rescue Plan Act of 2021 signed into law on March 11 2021 the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits for tax year 2020. That applies to individuals who earned less than 150000 in adjusted gross income in 2020.

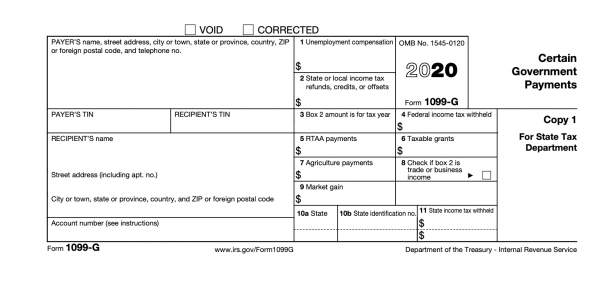

Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes. Written on May 17 2021. COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received.

After the IRS makes the adjustment the taxpayer must do all of the following. If you file electronically and request a paper check your refund will generally be. Used by employers to request a waiver of penalty and interest assessments resulting from filing a late quarterly tax return.

Ad File your unemployment tax return free. I was wondering if anyone received their additional refund yet. Such taxpayers are not entitled to any additional Ohio refund.

Welcome to the Ohio Department of Taxation refund inquiry web form. TurboTax Home Biz Windows. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest.

Due to the Federal American Rescue Plan Act of 2021 signed into law on March 11 2021 the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits for tax year 2020. Ohioans who paid federal andor state income taxes on unemployment benefits they received last year are entitled to a refund. COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received.

Taxpayers who previously filed their federal and Ohio returns prior to the enactment of this federal deduction and whose Ohio income tax liability amount IT 1040 line 10 was 0 do not need to. Individual Income Tax Information For Unemployment Insurance Recipients. 66 on taxable income above.

Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. ODJFS issued approximately 17 million 1099-G forms in 2021 and 200000 forms in 2020-30- The Ohio Department of Job and Family Services manages vital programs that strengthen Ohio families. Taxpayers who previously filed federal and Ohio tax returns without the unemployment benefits deduction but who are not entitled to any additional Ohio refund.

Should you have any questions please call the contribution section at 614-466-2319. If you have additional questions with filing your Ohio return please call the Department of Taxation at 1-800-282-1780 to speak with a representative. JFS-20129 Request to Amend the Quarterly Tax Return.

People who received unemployment benefits last year and filed tax. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment. I filed as single but have not received my tax break yet.

Used by employers to amend an original quarterly tax return. To amend an original report online please visit httpsthesourcejfsohiogov. Certain married taxpayers who both received unemployment benefits can each.

Federal and Ohio tax returns without the unemployment benefits deduction and are now waiting for the IRS to issue a refund. To obtain the refund status of your 2021 tax return you must enter your social security number your date of birth the type of tax and whether it is an amended return. If you do not wish to submit your personal information over the Internet you may call our automated refund hotline at 1-800-282-1784.

Check My Refund Status. 100 free federal filing for everyone. The amount of tax will depend on your tax bracket.

If you do not wish to submit your personal information over the Internet you may. See I filed mine too before the the tax break and paid 2254 from collecting. O Taxpayers who previously filed their federal and Ohio returns prior to the enactment of this federal deduction and whose Ohio income tax liability amount IT 1040 line 10 was 0 do not need to take any additional action.

They are included in the gross income number taken from the federal filing to start the state tax form. Federal and Ohio tax returns without the unemployment benefits deduction and are now waiting for the IRS to issue a refund. You may apply for a waiver of these assessments.

If you file electronically and request direct deposit your refund will generally be issued within 15 business days. The change in a bill signed by Gov. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

Normally unemployment benefits are considered taxable income but the relief package passed by Congress in March exempted up to 10200 in benefits for taxpayers with a 2020 income of up to 150000. However unemployment benefits received in 2020 and 2021 are exempt from tax. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI.

22 on taxable income from 2001 to 5000. Unemployment benefits deduction but who are not entitled to any additional Ohio refund. Premium federal filing is 100 free with no upgrades for premium taxes.

State Income Tax Range. To obtain the refund status of your current year tax return you must enter your social security number your date of birth the type of tax and whether it is an amended return. The processing time of your refund will depend on your method of filing.

If unemployment benefits are included in federal adjusted gross income AGI they are taxed under Ohio law. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. I thought that unemployment benefits were not taxable by the state of Ohio.

Used by employers to amend an original quarterly tax return.

Time Running Out For Ohioans Claiming 2017 Tax Refund

State Income Tax Returns And Unemployment Compensation

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Surprise Tax Forms Reveal Extend Of Unemployment Fraud Omaha Daily Record

Income School District Tax Department Of Taxation

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Ohioans Who Paid Income Tax On Last Year S Unemployment Benefits May Get Refunds Cleveland Com

Where S My Refund Ohio H R Block

Ohio Doing More This Year To Warn Unemployment Fraud Victims Ahead Of Tax Season Cleveland Com

Ohio Income Tax Update Unemployment Benefits Whalen Company Cpas

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago